IGIC tax in the Canary Islands - What is it?

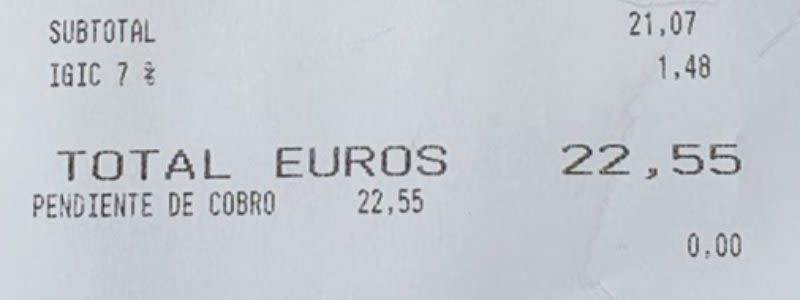

Have you ever wondered what the 7% IGIC tax is on when you've got your restaurant check in the Canary Islands?

What is IGIC in the Canary Islands?

We get this question often, so here is the answer: IGIC stands for "Impuesto General Indirecto Canario," which translates to the General Indirect Canary Islands Tax.

IGIC is a value-added tax (VAT) or consumption tax that applies in the Canary Islands, an autonomous community of Spain. IGIC is the equivalent of VAT (IVA in Spanish) that is applied in other parts of Spain and the European Union, but it is lower than VAT usually is.

The IGIC tax rate can vary depending on the type of goods or services being taxed.

- General Rate: The standard rate is 7%.

- Reduced Rate: A reduced rate of 3% is applied to certain specific goods and services

- Super-Reduced Rate: A super-reduced rate of 0% applies to a very limited number of essential items, such as certain medicines.

Note for visitors: the IGIC on your restaurant check is not service tax, it's simply the equivalent of VAT

As a tourist visiting the Canary Islands, you will most often see the IGIC tax on your restaurant check, in the amount of 7%. This 7% tax that you see on your bill is not a service tax added by the restaurant, as some visitors assume, but it is just the IGIC tax (the equivalent of VAT) and it is NOT OPTIONAL to pay.

The IGIC tax applies to the entire Canary Islands archipelago, so you will see it under this name in Tenerife, Gran Canaria, Lanzarote, Fuerteventura, La Palma, La Gomera, El Hierro and La Gracios.